11 months ago

The cryptocurrency market today remains one of the most dynamic and unpredictable financial sectors. It continues to attract significant attention from investors, institutions, and governments worldwide. On one hand, cryptocurrencies like Bitcoin and Ethereum have solidified their positions as leading digital assets, demonstrating resilience despite market volatility. On the other hand, the emergence of new projects, tokens, and technologies keeps reshaping the landscape, offering both opportunities and risks.

One notable trend is the increasing institutional adoption. Large companies and financial institutions are integrating blockchain technology and cryptocurrencies into their operations, signaling growing legitimacy for the market. Additionally, the rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has opened up innovative ways for users to interact with digital assets.

However, the market is still heavily influenced by regulatory developments. Governments around the world are working to establish clear rules for cryptocurrency usage, which can either bolster investor confidence or create uncertainty depending on the approach taken. The volatility of crypto prices also remains a critical challenge, as it can deter risk-averse investors while simultaneously attracting speculative traders.

Overall, the cryptocurrency market is evolving rapidly, driven by technological advancements and shifting economic conditions. While it offers immense potential for growth and innovation, it also requires careful navigation due to its inherent risks and unpredictability.

One notable trend is the increasing institutional adoption. Large companies and financial institutions are integrating blockchain technology and cryptocurrencies into their operations, signaling growing legitimacy for the market. Additionally, the rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has opened up innovative ways for users to interact with digital assets.

However, the market is still heavily influenced by regulatory developments. Governments around the world are working to establish clear rules for cryptocurrency usage, which can either bolster investor confidence or create uncertainty depending on the approach taken. The volatility of crypto prices also remains a critical challenge, as it can deter risk-averse investors while simultaneously attracting speculative traders.

Overall, the cryptocurrency market is evolving rapidly, driven by technological advancements and shifting economic conditions. While it offers immense potential for growth and innovation, it also requires careful navigation due to its inherent risks and unpredictability.

1 yr. ago

🇺🇸 The latest report from the US Treasury Department states that “the primary use case for #Bitcoin appears to be as a store of value, aka ‘digital gold’ in the DeFi world.”

The report adds that "speculative interest appears to have played a significant role in the growth of digital tokens so far."

“The market cap of digital assets remains small relative to other financial and real assets, and growth so far does not appear to have cannibalized demand for Treasuries.”

The report adds that "speculative interest appears to have played a significant role in the growth of digital tokens so far."

“The market cap of digital assets remains small relative to other financial and real assets, and growth so far does not appear to have cannibalized demand for Treasuries.”

1 yr. ago

VIRTUALS INTEGRATION

Trade virtuals_io tokens PRE and POST bonding curve now with Maestro!

Paste your favorite AI agent’s CA and trade directly using ETH on Base.

Maestro brings you accurate token data—see the Red Pill in progress right inside the token report!

Need to bridge funds first? Type /bridge into the bot to begin.

https://t.me/Maestro

Trade virtuals_io tokens PRE and POST bonding curve now with Maestro!

Paste your favorite AI agent’s CA and trade directly using ETH on Base.

Maestro brings you accurate token data—see the Red Pill in progress right inside the token report!

Need to bridge funds first? Type /bridge into the bot to begin.

https://t.me/Maestro

1 yr. ago

Today is GAME NIGHT.

Join the @DougDuckSol TG to take part.

You will have the chance to win some tokens, if you manage to beat the community.

Join the @DougDuckSol TG to take part.

You will have the chance to win some tokens, if you manage to beat the community.

1 yr. ago

POPDOG is excited to announce a major gaming partnership with

Cuberium (https://x.com/Cuberium)! 🤝

The first mobile Game for MEMES on the App Store where you can earn $POPDOG tokens while playing with our character! 🕹️

POPDOG will be integrated into the game very soon! Stay tuned! 👀

Cuberium (https://x.com/Cuberium)! 🤝

The first mobile Game for MEMES on the App Store where you can earn $POPDOG tokens while playing with our character! 🕹️

POPDOG will be integrated into the game very soon! Stay tuned! 👀

1 yr. ago

Those trending SOL tokens share so much similar patterns, its incredible.

I am seeing that buying after a -50% drop from the entry allow me an even higher winrate.

I am seeing that buying after a -50% drop from the entry allow me an even higher winrate.

1 yr. ago

Daily Memecoin Recap - November 7

Sol above $200 , can life get any better?

Cobie’s Coin?

$uponly -> hit $44 .95m, cobie, he burned tokens worth $17 million and told the community to leave him out of this in the future

$cobie -> hit $4m

Happy Cat Owner Launch

$happy -> hit $20m , official happy cat coin, HappyCatArcade

Bome Dev

$smr -> hit $622m , 98.7% bundled and sent to darkfarms1

#rosspepe -> hit $11m , $bome dev created a $pepe + Ross Ulbricht piece, who is speculated to be freed by Trump in January

High Volume

#zerebro -> $23m to $72m (3.1x)

$jarvis -> $1 .4m to $5 .75m (4.1x)

$happy -> hit $20m , official happy cat coin

$monkey -> hit $19m

$pythia -> hit $8 .3m, world’s first cyber rat

#cataclaws -> hit $5 .1m, lego's new mascot

#petunia -> hit $5m , viral tiktok hippo

$tds -> hit $4 .8m, Trump Derangement Syndrome, collab of angry liberals

Moo Deng Higher High

#moodeng -> $137m to $286m (2.1x)

Official Mascot Church Of Satan

$lola -> hit $7 .7m

$degen -> hit $4m

$diablo -> hit $3 .67m

More Cooks

#fartcoin -> $54m to $96m (1.7x)

$e /acc -> $15m to $36m (2.4x)

$mwah -> $471k to $2m (4.2x), cat meme

$GENZ -> $442k to $2m (4.5x)

$slurp -> $410k to $1 .8m (4.4x)

$bros -> $260k to $767k (2.9x)

#gigacycle -> $117k to $576k (4.9x)

#3ac -> hit $14 .5m

$tobi -> hit $2m , frog meme

$late -> hit $1 .4m

$wealth -> hit $1 .4m

$thend -> hit $1 .1m, Thend it! Meme with a lisp

$mmga -> hit $1 .1m, make memes great again

$ass -> hit $950k

$fog -> hit $700k

$sec -> hit $583k , SPIRITUALLYENLIGHTENEDCONSCIOUS

$play -> hit $524k

$dogo -> hit $500k

$pwut -> hit $482k , $pnut + $fwog

#solcycle -> hit $350k

$ligma -> hit $305k , lego $sigma

We are so early

Sol above $200 , can life get any better?

Cobie’s Coin?

$uponly -> hit $44 .95m, cobie, he burned tokens worth $17 million and told the community to leave him out of this in the future

$cobie -> hit $4m

Happy Cat Owner Launch

$happy -> hit $20m , official happy cat coin, HappyCatArcade

Bome Dev

$smr -> hit $622m , 98.7% bundled and sent to darkfarms1

#rosspepe -> hit $11m , $bome dev created a $pepe + Ross Ulbricht piece, who is speculated to be freed by Trump in January

High Volume

#zerebro -> $23m to $72m (3.1x)

$jarvis -> $1 .4m to $5 .75m (4.1x)

$happy -> hit $20m , official happy cat coin

$monkey -> hit $19m

$pythia -> hit $8 .3m, world’s first cyber rat

#cataclaws -> hit $5 .1m, lego's new mascot

#petunia -> hit $5m , viral tiktok hippo

$tds -> hit $4 .8m, Trump Derangement Syndrome, collab of angry liberals

Moo Deng Higher High

#moodeng -> $137m to $286m (2.1x)

Official Mascot Church Of Satan

$lola -> hit $7 .7m

$degen -> hit $4m

$diablo -> hit $3 .67m

More Cooks

#fartcoin -> $54m to $96m (1.7x)

$e /acc -> $15m to $36m (2.4x)

$mwah -> $471k to $2m (4.2x), cat meme

$GENZ -> $442k to $2m (4.5x)

$slurp -> $410k to $1 .8m (4.4x)

$bros -> $260k to $767k (2.9x)

#gigacycle -> $117k to $576k (4.9x)

#3ac -> hit $14 .5m

$tobi -> hit $2m , frog meme

$late -> hit $1 .4m

$wealth -> hit $1 .4m

$thend -> hit $1 .1m, Thend it! Meme with a lisp

$mmga -> hit $1 .1m, make memes great again

$ass -> hit $950k

$fog -> hit $700k

$sec -> hit $583k , SPIRITUALLYENLIGHTENEDCONSCIOUS

$play -> hit $524k

$dogo -> hit $500k

$pwut -> hit $482k , $pnut + $fwog

#solcycle -> hit $350k

$ligma -> hit $305k , lego $sigma

We are so early

1 yr. ago

Daily Memecoin Recap - October 21

Amazing volume, AI meta continues to lead

Terminal Of Fun

$fun -> hit $15m

- Claiming to be an AI bot that analyzes tokens and trades accordingly

- Dev rugged multiple times, people think it's a larp

Glif Founder - An AI company

$slop -> hit $50m , AI generated art

$wmm -> hit $4 .29m, fabianstelzer

created an LLM that creates medieval illustrations

#strawberry -> hit $2 .64m, fabianstelzer tweet

$glif -> hit $2 .39m, First AI sandbox

Look Comes Back To Life

$look -> $662k to $8 .3m (12.5x), Look bro...

- Viral meme

- Soft shilled by Ansem & Murad

Terminal Of Truths

#fartcoin -> hit $50m , truth_terminal tweet

$catgf -> hit $10m

$cp -> hit $1 .7m, truth terminal's first meme

#goerner -> hit $355k , truth_terminal tweet

- Controversy over $goat after truth_terminal made a typo & people are saying it's suspicious cause AI never makes typos

Top Artificial Intelligence Cooks

$shegen -> $174k to $19 .2m (110x), AI with daddy issues

#terminal -> $5m to $15 .5m (3.1x), AI KOL

$gmika -> $877k to $10m (11.4x)

$omega -> $167k to $5m (29.9x)

$act -> hit $52m , Act 1: The AI Prophecy

#shoggoth -> hit $45m , octopus-like creature symbolizes AI

$kiri -> hit $22m

$wotf -> hit $17 .5m

$janet -> hit $13 .9m, NeuralJanet

pushed this one on $eth

$nussi -> hit $6m , dev burned $180k +

$enki -> hit $4m

More AI

$wibwob -> hit $2 .69m

$burzen -> hit $2 .67m

$01 -> hit $1 .91m, binary language, 0's and 1's

#attention -> hit $1 .66m, based on a paper that revolutionized AI

$solm -> hit $1 .45m, AI application

#remiliai -> hit $630k , Remilio AI

$ggc -> hit $430k , golden gate claude

Insider Play

$kwif -> $20k to $6m (300x), kitten wif hat

- Has been dead since April

- Wants to run a space for 1 week straight

More Cooks

$fubb -> hit $5 .3m, good art

#p5js -> hit $1 .53m

$iwo -> hit $823k , illuminati

$llm -> hit $556k , Limited Language Model

$ct -> hit $320k , conspiracy theory

A lot of these "AI agents" are just larps

How do you feel about the AI meta?

Amazing volume, AI meta continues to lead

Terminal Of Fun

$fun -> hit $15m

- Claiming to be an AI bot that analyzes tokens and trades accordingly

- Dev rugged multiple times, people think it's a larp

Glif Founder - An AI company

$slop -> hit $50m , AI generated art

$wmm -> hit $4 .29m, fabianstelzer

created an LLM that creates medieval illustrations

#strawberry -> hit $2 .64m, fabianstelzer tweet

$glif -> hit $2 .39m, First AI sandbox

Look Comes Back To Life

$look -> $662k to $8 .3m (12.5x), Look bro...

- Viral meme

- Soft shilled by Ansem & Murad

Terminal Of Truths

#fartcoin -> hit $50m , truth_terminal tweet

$catgf -> hit $10m

$cp -> hit $1 .7m, truth terminal's first meme

#goerner -> hit $355k , truth_terminal tweet

- Controversy over $goat after truth_terminal made a typo & people are saying it's suspicious cause AI never makes typos

Top Artificial Intelligence Cooks

$shegen -> $174k to $19 .2m (110x), AI with daddy issues

#terminal -> $5m to $15 .5m (3.1x), AI KOL

$gmika -> $877k to $10m (11.4x)

$omega -> $167k to $5m (29.9x)

$act -> hit $52m , Act 1: The AI Prophecy

#shoggoth -> hit $45m , octopus-like creature symbolizes AI

$kiri -> hit $22m

$wotf -> hit $17 .5m

$janet -> hit $13 .9m, NeuralJanet

pushed this one on $eth

$nussi -> hit $6m , dev burned $180k +

$enki -> hit $4m

More AI

$wibwob -> hit $2 .69m

$burzen -> hit $2 .67m

$01 -> hit $1 .91m, binary language, 0's and 1's

#attention -> hit $1 .66m, based on a paper that revolutionized AI

$solm -> hit $1 .45m, AI application

#remiliai -> hit $630k , Remilio AI

$ggc -> hit $430k , golden gate claude

Insider Play

$kwif -> $20k to $6m (300x), kitten wif hat

- Has been dead since April

- Wants to run a space for 1 week straight

More Cooks

$fubb -> hit $5 .3m, good art

#p5js -> hit $1 .53m

$iwo -> hit $823k , illuminati

$llm -> hit $556k , Limited Language Model

$ct -> hit $320k , conspiracy theory

A lot of these "AI agents" are just larps

How do you feel about the AI meta?

1 yr. ago

Will Ethereum remain institutions' top choice?

jonahrobrts breaks down the blockchain competition for TradFi's attention 🤼♂️

========================================

Disruption. Digitization. Financial inclusion. Future-proofing.

What do all of these oft-repeated buzzwords have in common? They’ve all been used by crypto-pilled associates at TradFi firms to pitch their bosses on the exciting upside of blockchain tech. This year, it seems, the executives are listening.

Institutions jumped into crypto more headlong than ever in 2024. Their moves are starting to bridge the gap between TradFi and DeFi. However, this article isn’t focused on why firms are building onchain. Instead, we are focusing on where these funds are choosing to build.

----------------------------

What’s Happening on Ethereum?

Ethereum is the world’s largest smart-contract blockchain network. It has secured over $90 billion in RWAs, including stablecoins. 2024 has been a big year for the adoption of non-stablecoin RWAs on Ethereum as well, with the network growing its onchain U.S. treasuries, bonds, and cash equivalents from $800 million to over $1 .5 billion and overall non-stablecoin RWA value to $2 .9 billion.

Some of the major players building on Ethereum this year include

Visa, BlackRock and FTI_US

Earlier this month, Visa announced that they are building the Visa Tokenized Asset Platform (VTAP) on Ethereum. This is the company’s biggest step toward crypto adoption thus far. VTAP enables Visa to issue and manage fiat-backed tokens on Ethereum. It is intended to be a sandbox for participating financial institutional partners to create and experiment with fiat-backed tokens. They expect to begin piloting the platform with Spanish multinational bank BBVA in 2025. While the VTAP program is certainly an experiment, it gives credit to the thesis that TradFi will migrate its operations onto Ethereum over the coming decades.

----------------------------

Yet, the success of Ethereum’s competitors highlights a critical point: institutions are no longer bound to a single network. While Ethereum is foundational, blockchains like Solana and Stellar provide alternatives that are increasingly hard to ignore. However, they also present novel interoperability concerns.

Interoperability is central to the future of institutional blockchain adoption. As Visa states in their VTAP press release announcement, the largest benefits of building onchain include easy integration, programmability, and interoperability. Institutions that venture onto non-EVM chains like Solana or Stellar may face challenges in asset liquidity and protocol compatibility. This can lead to reliance on third-party services to bridge assets between chains, which introduces complexity and security risks. Ethereum’s widespread use means that staying within the EVM ecosystem—whether through Ethereum or Layer 2 solutions—remains the simplest and most secure option for institutions.

----------------------------

However, for Ethereum to maintain its lead in the race toward institutional adoption, it must continue to balance world-class security and stability with the performance and scalability that competing chains continue to push. The race to capture the attention of institutional finance will be won by the network that can not only meet today’s demands but also anticipate the needs of tomorrow. Ethereum is well-positioned for now, but staying on top will require constant evolution.

jonahrobrts breaks down the blockchain competition for TradFi's attention 🤼♂️

========================================

Disruption. Digitization. Financial inclusion. Future-proofing.

What do all of these oft-repeated buzzwords have in common? They’ve all been used by crypto-pilled associates at TradFi firms to pitch their bosses on the exciting upside of blockchain tech. This year, it seems, the executives are listening.

Institutions jumped into crypto more headlong than ever in 2024. Their moves are starting to bridge the gap between TradFi and DeFi. However, this article isn’t focused on why firms are building onchain. Instead, we are focusing on where these funds are choosing to build.

----------------------------

What’s Happening on Ethereum?

Ethereum is the world’s largest smart-contract blockchain network. It has secured over $90 billion in RWAs, including stablecoins. 2024 has been a big year for the adoption of non-stablecoin RWAs on Ethereum as well, with the network growing its onchain U.S. treasuries, bonds, and cash equivalents from $800 million to over $1 .5 billion and overall non-stablecoin RWA value to $2 .9 billion.

Some of the major players building on Ethereum this year include

Visa, BlackRock and FTI_US

Earlier this month, Visa announced that they are building the Visa Tokenized Asset Platform (VTAP) on Ethereum. This is the company’s biggest step toward crypto adoption thus far. VTAP enables Visa to issue and manage fiat-backed tokens on Ethereum. It is intended to be a sandbox for participating financial institutional partners to create and experiment with fiat-backed tokens. They expect to begin piloting the platform with Spanish multinational bank BBVA in 2025. While the VTAP program is certainly an experiment, it gives credit to the thesis that TradFi will migrate its operations onto Ethereum over the coming decades.

----------------------------

Yet, the success of Ethereum’s competitors highlights a critical point: institutions are no longer bound to a single network. While Ethereum is foundational, blockchains like Solana and Stellar provide alternatives that are increasingly hard to ignore. However, they also present novel interoperability concerns.

Interoperability is central to the future of institutional blockchain adoption. As Visa states in their VTAP press release announcement, the largest benefits of building onchain include easy integration, programmability, and interoperability. Institutions that venture onto non-EVM chains like Solana or Stellar may face challenges in asset liquidity and protocol compatibility. This can lead to reliance on third-party services to bridge assets between chains, which introduces complexity and security risks. Ethereum’s widespread use means that staying within the EVM ecosystem—whether through Ethereum or Layer 2 solutions—remains the simplest and most secure option for institutions.

----------------------------

However, for Ethereum to maintain its lead in the race toward institutional adoption, it must continue to balance world-class security and stability with the performance and scalability that competing chains continue to push. The race to capture the attention of institutional finance will be won by the network that can not only meet today’s demands but also anticipate the needs of tomorrow. Ethereum is well-positioned for now, but staying on top will require constant evolution.

1 yr. ago

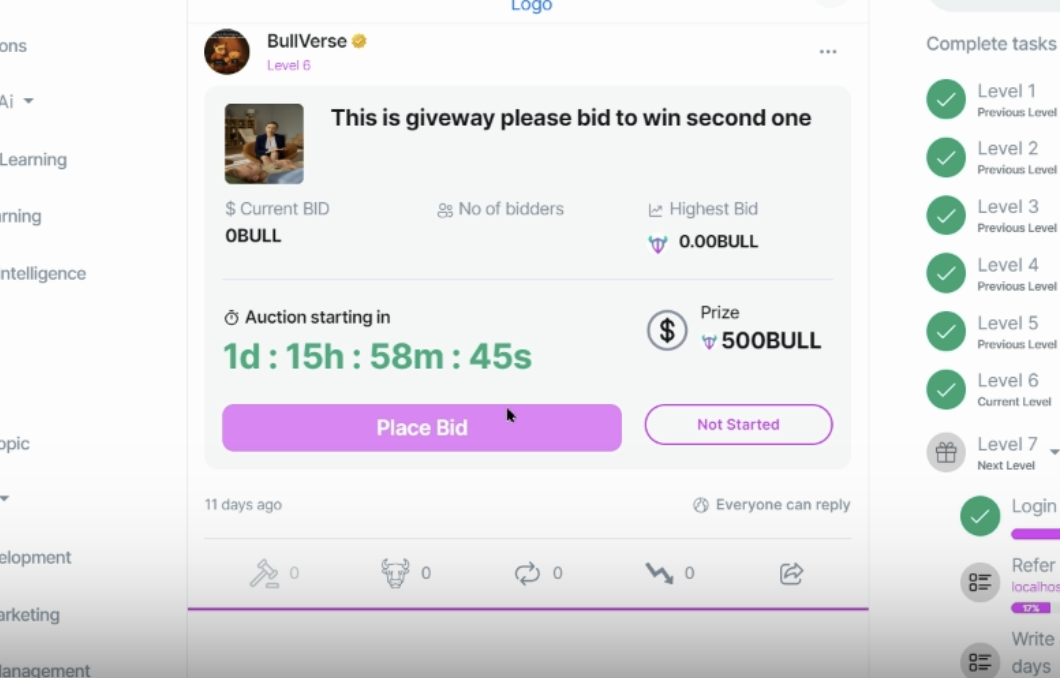

🎁 How do giveaways work on BullVerse?

• A known or mystery prize 🎉 is attached to the giveaway.

Example: 10 SOL

• A minimum bid amount 💰 is set by the creator.

Example: 0.01 SOL

• Users must place bids to get a chance to win 🎯.

• The highest bidder 🏆 wins the prize.

• All bid payments 💸 go to the giveaway creator.

• Sniping protection ⏳ is in place! The giveaway’s end time gets extended for a few minutes if a last-minute bid is submitted.

• $BULL and partner tokens can be set as prizes 🎁.

When creating a giveaway, the creator processes a transaction 🔐 to lock the prize and ensure the winner gets paid.

Only on BullVerse! 🚀

• A known or mystery prize 🎉 is attached to the giveaway.

Example: 10 SOL

• A minimum bid amount 💰 is set by the creator.

Example: 0.01 SOL

• Users must place bids to get a chance to win 🎯.

• The highest bidder 🏆 wins the prize.

• All bid payments 💸 go to the giveaway creator.

• Sniping protection ⏳ is in place! The giveaway’s end time gets extended for a few minutes if a last-minute bid is submitted.

• $BULL and partner tokens can be set as prizes 🎁.

When creating a giveaway, the creator processes a transaction 🔐 to lock the prize and ensure the winner gets paid.

Only on BullVerse! 🚀

1 yr. ago

🟨 $GOLD TOKEN SOLANA

🥇 Telegram: https://t.co/wt3uddIK5u

🐦 Twitter: https://x.com/goldtokensol

🌎 Website: WWW.GOLDTOKENSOLANA.COM (https://www.goldtokensolan.../)

📈 Chart: https://dexscreener.com/so...

✅ CA: 79eXoT1aR7qhBMGKXzVNdV4ZcLqHsupqj2WTFvDumpSZ

🥇 Telegram: https://t.co/wt3uddIK5u

🐦 Twitter: https://x.com/goldtokensol

🌎 Website: WWW.GOLDTOKENSOLANA.COM (https://www.goldtokensolan.../)

📈 Chart: https://dexscreener.com/so...

✅ CA: 79eXoT1aR7qhBMGKXzVNdV4ZcLqHsupqj2WTFvDumpSZ

1 yr. ago

📢 This account will be dropping high-success signals for tokens on Solana! 🚀

🔔 Make sure to turn on your notifications! 📲✨

🔔 Make sure to turn on your notifications! 📲✨

1 yr. ago

(E)

I have asked around for a way to automate safety checks of Sui tokens and ended up finding the creator of Insidex App who gave me his api.

It has always been who you know and will always be...

It has always been who you know and will always be...

1 yr. ago

The AI x Crypto narrative is on a tear and

bittensor_

's $TAO token is leading the way 🚀

Here's why 👇

======================

As one of the most prominent projects in this space, Bittensor is positioning itself as the project to watch.

At its core, Bittensor is pushing a new frontier: creating a decentralized network where AI models can be trained and shared in a way that aligns incentives for both developers and users.

As the subnet limit is progressively expanded — and eventually removed altogether — the potential for exponential growth within the Bittensor ecosystem becomes clear. More subnets mean more AI models, more collaboration, and more growth for the ecosystem.

Crucially, all this activity increases demand for TAO itself. Since TAO is required to acquire any subnet token, the introduction of dTAO could further fuel its demand, making Bittensor even more attractive to investors.

TAO’s Halving in 2025

Bittensor is approaching its first halving event, slated for late 2025. Much like Bitcoin’s halving cycles, this event will cut the rate at which new TAO tokens are emitted by half.

Currently, the Bittensor network emits 1 TAO as block rewards (7,200 TAO daily) which are distributed among miners, validators, subnet owners, and delegators. However, when the halving occurs (triggered when 10.5 million TAO are in circulation), this emission will be halved to 0.5 TAO per block, reducing the daily supply of new TAO entering the market.

Why does this matter? When the supply of TAO is cut, it introduces scarcity. In any market, reduced supply with steady or rising demand (thanks to increasing subnets and introduction of dTAO) can only lead in one direction: upward.

Now let’s take a look at the macro level things happening in the world of AI that are considered positive for AI x crypto projects like Bittensor.

Issues with OpenAI

OpenAI is at a crossroads. Recently, news broke that OpenAI is transitioning from a non-profit control to a for-profit benefit corporation. Following this restructuring, the company’s valuation has soared to over $150 billion and they’ve raised $6 .6 billion in fresh funding.

Additionally, there’s been recent departures of key executives, including Chief Technology Officer Mira Murati and two other senior executives, raising concerns about potential internal issues.

Nonetheless, there is a broad regulatory squeeze on AI from various jurisdictions worldwide. The fact that centralized AI is subject to regulatory control highlights a fundamental flaw: it's too easy to control.

When a few large companies hold the keys to centralized AI, they become prime targets for government pressure and censorship. This is where decentralized AI platforms, like Bittensor, have the advantage. They cannot be shut down or censored by any single entity, as no one entity controls it.

Closing Thoughts

There’s a lot going right for Bittensor, and the rising token price is just the cherry on top. With existing momentum, the upcoming updates mentioned above, potential EVM support, and ongoing community development – such as the rapid integration of NousResearch’s breakthrough in distributed training into Bittensor – these are all strong indicators of Bittensor’s promise.

In a world where centralized AI is increasingly regulated, censored, and driven by profit motives, Bittensor offers a compelling alternative: a decentralized, community-driven approach that thrives on collaboration, innovation, and shared incentives. And that’s why it’s worth keeping an eye on.

Analysis by arjunnchand✍️

bittensor_

's $TAO token is leading the way 🚀

Here's why 👇

======================

As one of the most prominent projects in this space, Bittensor is positioning itself as the project to watch.

At its core, Bittensor is pushing a new frontier: creating a decentralized network where AI models can be trained and shared in a way that aligns incentives for both developers and users.

As the subnet limit is progressively expanded — and eventually removed altogether — the potential for exponential growth within the Bittensor ecosystem becomes clear. More subnets mean more AI models, more collaboration, and more growth for the ecosystem.

Crucially, all this activity increases demand for TAO itself. Since TAO is required to acquire any subnet token, the introduction of dTAO could further fuel its demand, making Bittensor even more attractive to investors.

TAO’s Halving in 2025

Bittensor is approaching its first halving event, slated for late 2025. Much like Bitcoin’s halving cycles, this event will cut the rate at which new TAO tokens are emitted by half.

Currently, the Bittensor network emits 1 TAO as block rewards (7,200 TAO daily) which are distributed among miners, validators, subnet owners, and delegators. However, when the halving occurs (triggered when 10.5 million TAO are in circulation), this emission will be halved to 0.5 TAO per block, reducing the daily supply of new TAO entering the market.

Why does this matter? When the supply of TAO is cut, it introduces scarcity. In any market, reduced supply with steady or rising demand (thanks to increasing subnets and introduction of dTAO) can only lead in one direction: upward.

Now let’s take a look at the macro level things happening in the world of AI that are considered positive for AI x crypto projects like Bittensor.

Issues with OpenAI

OpenAI is at a crossroads. Recently, news broke that OpenAI is transitioning from a non-profit control to a for-profit benefit corporation. Following this restructuring, the company’s valuation has soared to over $150 billion and they’ve raised $6 .6 billion in fresh funding.

Additionally, there’s been recent departures of key executives, including Chief Technology Officer Mira Murati and two other senior executives, raising concerns about potential internal issues.

Nonetheless, there is a broad regulatory squeeze on AI from various jurisdictions worldwide. The fact that centralized AI is subject to regulatory control highlights a fundamental flaw: it's too easy to control.

When a few large companies hold the keys to centralized AI, they become prime targets for government pressure and censorship. This is where decentralized AI platforms, like Bittensor, have the advantage. They cannot be shut down or censored by any single entity, as no one entity controls it.

Closing Thoughts

There’s a lot going right for Bittensor, and the rising token price is just the cherry on top. With existing momentum, the upcoming updates mentioned above, potential EVM support, and ongoing community development – such as the rapid integration of NousResearch’s breakthrough in distributed training into Bittensor – these are all strong indicators of Bittensor’s promise.

In a world where centralized AI is increasingly regulated, censored, and driven by profit motives, Bittensor offers a compelling alternative: a decentralized, community-driven approach that thrives on collaboration, innovation, and shared incentives. And that’s why it’s worth keeping an eye on.

Analysis by arjunnchand✍️

1 yr. ago

🚨 87% of new tokens created in 2024 were on Solana.

Since May, Solana has averaged 100,000 new tokens per month.

Since May, Solana has averaged 100,000 new tokens per month.

1 yr. ago

10 years ago, on October 6, 2014, the first stablecoin was launched.

Called Realcoin, the first tokens were issued on the Omni overlay of the Bitcoin network.

Now called #Tether (USDT), over 120 billion tokens are in circulation and the company generated more profits than BlackRock in 2023!

Tether generates its yield from U.S. Treasuries, which the company holds more of than some countries, such as Germany.

Called Realcoin, the first tokens were issued on the Omni overlay of the Bitcoin network.

Now called #Tether (USDT), over 120 billion tokens are in circulation and the company generated more profits than BlackRock in 2023!

Tether generates its yield from U.S. Treasuries, which the company holds more of than some countries, such as Germany.

1 yr. ago

It's been around a week that I have been running simulations on trending tokens on Tron and the winrate would be 100% with proper volume settings and take profit.

Let's see how it will play in the long term...

Let's see how it will play in the long term...

1 yr. ago

At Solana Breakpoint 2024, Charles d’Haussy, CEO of the dYdX Foundation, discussed the protocols’s upcoming enhancements and muse on Solana’s growth.

While dYdX, one of the crypto industry’s oldest decentralized perpetual exchanges, runs its own sovereign appchain, the platform recently integrated Solana-based assets into its platform.

The move brought greater exposure to a wealth of Solana ecosystem tokens, allowing dYdX traders to express their opinion on assets like $SOL , $JUP , and $WIF .

Drawing on his rich experience in the industry, d’Haussy made fascinating remarks about Solana culture.

Solana Builder Energy

When dYdX governance moved to include more Solana-based assets via a Raydium integration in June, d’Haussy and the dYdX were hesitant to approach the Solana community.

“When we started to reach out to the Solana ecosystem, I was kind of cautious and trying to be gentle, not knowing exactly how we would be welcome for conversations about possible integration”

From an outside perspective, blockchain tribalism formed a perceived barrier to entry. Chain maximalism is a serious obstacle within the industry, which is further exacerbated by obstinate and outspoken communities on social media.

Fortunately, away from the noise and distractions of social media, the teams actually building these ecosystems are eager to collaborate and push the collectively push the industry forward. d’Haussy remarked that the Solana Foundation was welcoming and receptive to working alongside teams from alternative ecosystems in the pursuit of progress.

“We were really warmly welcomed. I think the Solana ecosystem has showed us, you want to connect to the Solana ecosystem and bring more mindshare to the Solana ecosystem via your own chain? How can we help you?… The Solana Foundation has been extremely welcoming, connecting us to plenty of people. And the builders were also very welcoming.”

“Sometimes Twitter makes you think that this is all tribes and they look at each other from afar. But the reality is the real builders and the people which are in the industry long enough and for the long term, they are very friendly and they want to grow the cake for everyone.”

Additionally, d’Haussy asserted that “Solana is like Ethereum five years ago”, highlighting the energy and hunger shown by developers building innovative products. The CEO drew comparisons between the atmosphere of week’s earlier Token 2049 conference and Solana Breakpoint.

“We are just out of three days of Token 2049, which is much more salesy and marketing and towards trading activities, which is really the audience of DYDX. So, that was perfect, we had a blast over there. Suddenly, you wake up the next morning and you're going to Solana Breakpoint.”

“It's a bit of a shock for me because suddenly we are surrounded by devs. So, there is this kind of change of seasons overnight between the projects and the business development atmosphere of Token 2049 and here the business, the atmosphere of building here at Solana.”

Blockchain tribalism is a regrettable obstacle, but easily overcome. As evidenced by dYdX and the Solana, teams from different chains can always find ways to work together in a way that benefits both parties and further advances the space.

While dYdX, one of the crypto industry’s oldest decentralized perpetual exchanges, runs its own sovereign appchain, the platform recently integrated Solana-based assets into its platform.

The move brought greater exposure to a wealth of Solana ecosystem tokens, allowing dYdX traders to express their opinion on assets like $SOL , $JUP , and $WIF .

Drawing on his rich experience in the industry, d’Haussy made fascinating remarks about Solana culture.

Solana Builder Energy

When dYdX governance moved to include more Solana-based assets via a Raydium integration in June, d’Haussy and the dYdX were hesitant to approach the Solana community.

“When we started to reach out to the Solana ecosystem, I was kind of cautious and trying to be gentle, not knowing exactly how we would be welcome for conversations about possible integration”

From an outside perspective, blockchain tribalism formed a perceived barrier to entry. Chain maximalism is a serious obstacle within the industry, which is further exacerbated by obstinate and outspoken communities on social media.

Fortunately, away from the noise and distractions of social media, the teams actually building these ecosystems are eager to collaborate and push the collectively push the industry forward. d’Haussy remarked that the Solana Foundation was welcoming and receptive to working alongside teams from alternative ecosystems in the pursuit of progress.

“We were really warmly welcomed. I think the Solana ecosystem has showed us, you want to connect to the Solana ecosystem and bring more mindshare to the Solana ecosystem via your own chain? How can we help you?… The Solana Foundation has been extremely welcoming, connecting us to plenty of people. And the builders were also very welcoming.”

“Sometimes Twitter makes you think that this is all tribes and they look at each other from afar. But the reality is the real builders and the people which are in the industry long enough and for the long term, they are very friendly and they want to grow the cake for everyone.”

Additionally, d’Haussy asserted that “Solana is like Ethereum five years ago”, highlighting the energy and hunger shown by developers building innovative products. The CEO drew comparisons between the atmosphere of week’s earlier Token 2049 conference and Solana Breakpoint.

“We are just out of three days of Token 2049, which is much more salesy and marketing and towards trading activities, which is really the audience of DYDX. So, that was perfect, we had a blast over there. Suddenly, you wake up the next morning and you're going to Solana Breakpoint.”

“It's a bit of a shock for me because suddenly we are surrounded by devs. So, there is this kind of change of seasons overnight between the projects and the business development atmosphere of Token 2049 and here the business, the atmosphere of building here at Solana.”

Blockchain tribalism is a regrettable obstacle, but easily overcome. As evidenced by dYdX and the Solana, teams from different chains can always find ways to work together in a way that benefits both parties and further advances the space.

1 yr. ago

PayPal, one of the world’s largest financial platforms, continues its mission to deliver blockchain-based services to users and businesses alike.

On September 25, 2024, PayPal announced it would be enabling U.S. merchants to buy, hold, and sell cryptocurrency assets within their business accounts. The move is the latest in a slew of updates made by PayPal as the TradFi giant continues to embrace the cryptocurrency industry.

U.S. Businesses Can Now Store Funds Onchain

Following the successful launch of crypto services for individual users, PayPal remarked that businesses were eager to meet user’s growing demand for more comprehensive crypto services.

"Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency… Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers. We're excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly." - Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies, PayPal.

PayPal’s commitment to providing merchants with expanded crypto services and flexibility goes beyond buying and selling digital assets. Merchants can now withdraw cryptocurrencies to external onchain wallets.

While PayPal has stipulated that this feature will be limited to “eligible” wallets, the move also opens the door to more businesses becoming involved in DeFi. For example, businesses holding capital might be able to lend out assets in various onchain lending protocols, earning additional yield on a merchant’s treasury.

$PYUSD Solana Supply Down 40% Since ATH

Since launching on Solana on May 29, 2024, $PYUSD enjoyed meteoric growth. Spurred on by generous liquidity provision incentives, $PYUSD’s Solana-based supply surged to over 663.4M tokens based on Step Finance data. This eclipsed Ethereum’s $PYUSD supply, making Solana the unofficial home of PayPal’s crypto services.

However, as $PYUSD reward campaigns have slowed and market conditions improved, the supply of PayPal USD on Solana has declined. At its highest point on August 28, 2024, Solana hosted $PYUSD 65.79% supply dominance.

Based on DeFiLlama data, that figure has since fallen to just 50.4%, with PayPal USD’s Solana-based supply currently sitting at 354M.

It's unlikely that PayPal merchants based in the U.S. will rush to bring their stablecoin holdings onchain and deploy them in Solana DeFi protocols. However, the move highlights PayPal’s willingness to respond positively to customer feedback and integrate blockchain technology into its expansive product suite.

On September 25, 2024, PayPal announced it would be enabling U.S. merchants to buy, hold, and sell cryptocurrency assets within their business accounts. The move is the latest in a slew of updates made by PayPal as the TradFi giant continues to embrace the cryptocurrency industry.

U.S. Businesses Can Now Store Funds Onchain

Following the successful launch of crypto services for individual users, PayPal remarked that businesses were eager to meet user’s growing demand for more comprehensive crypto services.

"Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency… Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers. We're excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly." - Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies, PayPal.

PayPal’s commitment to providing merchants with expanded crypto services and flexibility goes beyond buying and selling digital assets. Merchants can now withdraw cryptocurrencies to external onchain wallets.

While PayPal has stipulated that this feature will be limited to “eligible” wallets, the move also opens the door to more businesses becoming involved in DeFi. For example, businesses holding capital might be able to lend out assets in various onchain lending protocols, earning additional yield on a merchant’s treasury.

$PYUSD Solana Supply Down 40% Since ATH

Since launching on Solana on May 29, 2024, $PYUSD enjoyed meteoric growth. Spurred on by generous liquidity provision incentives, $PYUSD’s Solana-based supply surged to over 663.4M tokens based on Step Finance data. This eclipsed Ethereum’s $PYUSD supply, making Solana the unofficial home of PayPal’s crypto services.

However, as $PYUSD reward campaigns have slowed and market conditions improved, the supply of PayPal USD on Solana has declined. At its highest point on August 28, 2024, Solana hosted $PYUSD 65.79% supply dominance.

Based on DeFiLlama data, that figure has since fallen to just 50.4%, with PayPal USD’s Solana-based supply currently sitting at 354M.

It's unlikely that PayPal merchants based in the U.S. will rush to bring their stablecoin holdings onchain and deploy them in Solana DeFi protocols. However, the move highlights PayPal’s willingness to respond positively to customer feedback and integrate blockchain technology into its expansive product suite.

1 yr. ago

Jupiter, a leading decentralized exchange (DEX) on Solana, made a series of major announcements today at Solana Breakpoint 2024, the Solana ecosystem's largest annual conference. These updates include the acquisition of SolanaFM, the second-largest explorer on Solana, and Coinhall, the leading aggregator across Cosmos.

Co-founder Siong delivered a keynote address outlining the ambitious roadmap ahead for Jupiter.

Metropolis API Platform

Building on the foundation of Jupiter's existing APIs (Swap, Tokens, and Price APIs), the Metropolis API Platform makes it easier for developers to integrate with all of Solana's liquidity and build sustainable businesses. Anyone with an internet connection can leverage these APIs to streamline development and create innovative applications on Solana.

Jupiter RFQ

Deepening liquidity on Solana by connecting market makers directly to Jupiter's routing engine. This innovative feature allows market makers who primarily use exchanges like Binance to easily provide liquidity on Solana, ensuring that Jupiter consistently offers the best prices.

Jupiter Perps V2

Perps V2 is a significant upgrade from its predecessor, offering a richer feature set, competitive fees, and unmatched reliability. This new version introduces limit orders, a revamped Doves oracle for enhanced pricing accuracy, and gasless transactions, ensuring a seamless and cost-effective trading experience.

With Perps V2, traders can benefit from the convenience of limit orders, the reliability of the Dove oracle, and the efficiency of gasless transactions, all backed by $600 million in JLP liquidity. This combination makes Solana the most compelling platform for perpetual contracts.

Jupiter Mobile

Jupiter Mobile is poised to revolutionize how people interact with Solana by offering a frictionless and intuitive user experience. It simplifies the onboarding process, making Solana accessible to everyone regardless of their technical expertise. Users can easily connect their existing wallets or use popular payment methods like Apple Pay, Google Pay, or credit cards. Additionally, Jupiter Mobile eliminates the need for complex seed phrases, making it easy for new users to get started.

The platform also offers zero platform fees, ensuring that users can enjoy cost-effective transactions without worrying about hidden charges. With its 1-tap swap feature, users can effortlessly swap tokens with just a single click, streamlining the trading process.

Ape Pro: Taking on Pump.fun

Jupiter is now making moves to capture the meme coin market by taking on the popular Pump.fun, a no-code meme coin creation platform.

Ape Pro, a massive upgrade to the existing Ape platform, is set to make meme coins fun again on Solana. It will offer a powerful, mobile-friendly trading suite that supports social logins and an easy-to-use token creation experience.

Ape Pro stands out from its competitors, such as Pump.fun, by offering lower trading fees, a seamless mobile experience, faster transactions with Google login, and a robust token creation process. With a competitive 0.5% trading fee, Ape Pro provides a cost-effective solution for traders. Its mobile optimization ensures a smooth and efficient experience on the go, while Google login simplifies the onboarding process, eliminating the need for complex seed phrases. Additionally, Ape Mint, a feature within Ape Pro, allows users to easily mint new tokens, lock liquidity for project credibility, and earn perpetual swap fees, creating a sustainable revenue stream and combatting the current PVP model in the meme coin ecosystem.

Acquisitions Signal Growth and Ambition

Jupiter's acquisition of SolanaFM, a critical infrastructure provider for the Solana ecosystem, underscores the company's commitment to strengthening it. This move will enable Jupiter to leverage SolanaFM's world-class data infrastructure to enhance its platform further.

Co-founder Siong delivered a keynote address outlining the ambitious roadmap ahead for Jupiter.

Metropolis API Platform

Building on the foundation of Jupiter's existing APIs (Swap, Tokens, and Price APIs), the Metropolis API Platform makes it easier for developers to integrate with all of Solana's liquidity and build sustainable businesses. Anyone with an internet connection can leverage these APIs to streamline development and create innovative applications on Solana.

Jupiter RFQ

Deepening liquidity on Solana by connecting market makers directly to Jupiter's routing engine. This innovative feature allows market makers who primarily use exchanges like Binance to easily provide liquidity on Solana, ensuring that Jupiter consistently offers the best prices.

Jupiter Perps V2

Perps V2 is a significant upgrade from its predecessor, offering a richer feature set, competitive fees, and unmatched reliability. This new version introduces limit orders, a revamped Doves oracle for enhanced pricing accuracy, and gasless transactions, ensuring a seamless and cost-effective trading experience.

With Perps V2, traders can benefit from the convenience of limit orders, the reliability of the Dove oracle, and the efficiency of gasless transactions, all backed by $600 million in JLP liquidity. This combination makes Solana the most compelling platform for perpetual contracts.

Jupiter Mobile

Jupiter Mobile is poised to revolutionize how people interact with Solana by offering a frictionless and intuitive user experience. It simplifies the onboarding process, making Solana accessible to everyone regardless of their technical expertise. Users can easily connect their existing wallets or use popular payment methods like Apple Pay, Google Pay, or credit cards. Additionally, Jupiter Mobile eliminates the need for complex seed phrases, making it easy for new users to get started.

The platform also offers zero platform fees, ensuring that users can enjoy cost-effective transactions without worrying about hidden charges. With its 1-tap swap feature, users can effortlessly swap tokens with just a single click, streamlining the trading process.

Ape Pro: Taking on Pump.fun

Jupiter is now making moves to capture the meme coin market by taking on the popular Pump.fun, a no-code meme coin creation platform.

Ape Pro, a massive upgrade to the existing Ape platform, is set to make meme coins fun again on Solana. It will offer a powerful, mobile-friendly trading suite that supports social logins and an easy-to-use token creation experience.

Ape Pro stands out from its competitors, such as Pump.fun, by offering lower trading fees, a seamless mobile experience, faster transactions with Google login, and a robust token creation process. With a competitive 0.5% trading fee, Ape Pro provides a cost-effective solution for traders. Its mobile optimization ensures a smooth and efficient experience on the go, while Google login simplifies the onboarding process, eliminating the need for complex seed phrases. Additionally, Ape Mint, a feature within Ape Pro, allows users to easily mint new tokens, lock liquidity for project credibility, and earn perpetual swap fees, creating a sustainable revenue stream and combatting the current PVP model in the meme coin ecosystem.

Acquisitions Signal Growth and Ambition

Jupiter's acquisition of SolanaFM, a critical infrastructure provider for the Solana ecosystem, underscores the company's commitment to strengthening it. This move will enable Jupiter to leverage SolanaFM's world-class data infrastructure to enhance its platform further.

1 yr. ago

$HONEY , $MPLX , $CROWN Lead Solana Ecosystem Token Performance During Breakpoint

Which native tokens outperformed the market during Solana Breakpoint 2024?

Solana Breakpoint delivered a bounty of massive announcements not only for Solana, but also for a host of applications and projects building in the ecosystem.

However, market dynamics don’t always line up with protocol updates. Hype and speculation can push prices up ahead of the event, only to be met with disappointing price action when teams don’t deliver the news traders are hoping to hear.

On the other hand, projects that were ignored by speculative traders can enjoy solid price appreciation when they deliver unexpected announcements.

In the eyes of the market, who were Solana Breakpoint’s best and worst performers?

Solana Breakpoint Market Dynamics

To illustrate market dynamics during Breakpoint, analysts compiled and analyzed price data from 20 key projects in the ecosystem. Tokens were shortlisted from the following criteria:

In the industry’s top 1,000 tokens by market capitalization.

Made announcements, or participated in Breakpoint panels and debates.

If not presenting at the event, proven ecosystem OGs like Orca and Raydium were included.

Other than BONK Memecoins were excluded. BONK’s inclusion is due to its announcements and significant presence at the event.

Using Step Finance data, prices were pulled from Breakpoint’s opening and compared that with the price recorded at the closure of the event.

While the market anticipated big announcements from the likes of Jupiter and Sanctum, it was the projects that no one expected updates from who performed the best. $HONEY , $MPLX , and $CROWN outperformed the market, while most of the ecosystem remained largely unchanged.

Hivemapper, the company behind $HONEY , shared impressive growth statistics. The DePIN protocol has successfully mapped over 26% of the world’s road network and now sells mapping data to three of the ten largest mapmakers.

Metaplex, one of Solana’s longest-standing infrastructure providers, held a stealthy presentation in The Pod, one of Breakpoint’s smaller spaces. During the session, Metaplex teased the upcoming launch of the Metaplex Aura Network, a mysterious new addition to Metaplex’s product suite.

Finally, Photo Finish announced that its mobile app was approved for distribution on the Apple App Store. According to Photo Finish CEO, this makes the app the world’s first real-money horse racing mobile game approved by Apple.

However, Breakpoint is a relatively short event with plenty of other dynamics influencing price movements. For example, $CLOUD’s appears to have traded sideways during Breakpoint, but it needs to be said that the asset enjoyed an impressive surge both before and after the event.

Despite stale price action throughout Breakpoint, $CLOUD is up 67% on a weekly time frame and has been one of the Solana ecosystem’s best performers, based on Step Finance data.

Which native tokens outperformed the market during Solana Breakpoint 2024?

Solana Breakpoint delivered a bounty of massive announcements not only for Solana, but also for a host of applications and projects building in the ecosystem.

However, market dynamics don’t always line up with protocol updates. Hype and speculation can push prices up ahead of the event, only to be met with disappointing price action when teams don’t deliver the news traders are hoping to hear.

On the other hand, projects that were ignored by speculative traders can enjoy solid price appreciation when they deliver unexpected announcements.

In the eyes of the market, who were Solana Breakpoint’s best and worst performers?

Solana Breakpoint Market Dynamics

To illustrate market dynamics during Breakpoint, analysts compiled and analyzed price data from 20 key projects in the ecosystem. Tokens were shortlisted from the following criteria:

In the industry’s top 1,000 tokens by market capitalization.

Made announcements, or participated in Breakpoint panels and debates.

If not presenting at the event, proven ecosystem OGs like Orca and Raydium were included.

Other than BONK Memecoins were excluded. BONK’s inclusion is due to its announcements and significant presence at the event.

Using Step Finance data, prices were pulled from Breakpoint’s opening and compared that with the price recorded at the closure of the event.

While the market anticipated big announcements from the likes of Jupiter and Sanctum, it was the projects that no one expected updates from who performed the best. $HONEY , $MPLX , and $CROWN outperformed the market, while most of the ecosystem remained largely unchanged.

Hivemapper, the company behind $HONEY , shared impressive growth statistics. The DePIN protocol has successfully mapped over 26% of the world’s road network and now sells mapping data to three of the ten largest mapmakers.

Metaplex, one of Solana’s longest-standing infrastructure providers, held a stealthy presentation in The Pod, one of Breakpoint’s smaller spaces. During the session, Metaplex teased the upcoming launch of the Metaplex Aura Network, a mysterious new addition to Metaplex’s product suite.

Finally, Photo Finish announced that its mobile app was approved for distribution on the Apple App Store. According to Photo Finish CEO, this makes the app the world’s first real-money horse racing mobile game approved by Apple.

However, Breakpoint is a relatively short event with plenty of other dynamics influencing price movements. For example, $CLOUD’s appears to have traded sideways during Breakpoint, but it needs to be said that the asset enjoyed an impressive surge both before and after the event.

Despite stale price action throughout Breakpoint, $CLOUD is up 67% on a weekly time frame and has been one of the Solana ecosystem’s best performers, based on Step Finance data.

1 yr. ago

🚨 Visa is working on a tokenized asset platform for banks and wants to launch a first pilot project in 2025 on Ethereum.

“We believe this creates a significant opportunity for banks to issue their own trust-backed tokens on blockchains, to do so in a regulated manner, and to enable their clients to access and participate in these onchain capital markets.”

“We believe this creates a significant opportunity for banks to issue their own trust-backed tokens on blockchains, to do so in a regulated manner, and to enable their clients to access and participate in these onchain capital markets.”

1 yr. ago

🔶 Binance becomes the first exchange to launch spot trading of real tokens in pre-market.

That is to say, unlike competitors who offer derivatives trading, Binance will allow users to take "early" positions before the official launch of a token.

“Binance is the only crypto exchange to offer pre-market spot trading, where tokens will be exclusively allocated and generated for users to hold and trade on the Binance platform.”

That is to say, unlike competitors who offer derivatives trading, Binance will allow users to take "early" positions before the official launch of a token.

“Binance is the only crypto exchange to offer pre-market spot trading, where tokens will be exclusively allocated and generated for users to hold and trade on the Binance platform.”

1 yr. ago

You got enough of all these Pump and Dump Schemes? All these project that simply exist so that the so called "Devs" can use their Communitiy as exit liquidity?

At BEMEOW we do things different!! We bring intrinsic value to the Memecoin space and enable the Community to participate in launching Memecoins.

We launch TAX TOKENS!!! So we don't earn from dumping on the community. We earn from Volume & Volatility as it should be. And we reinvest 80% of these Taxes into Buybacks, Rewarding the Community and Growing the Ecosystem. 😺

Let's rebuild this screwed Memecoin Space from the Scratch TOGETHER and mark a new Standard of what a good Memecoin is 💖💖💖

Our Presale App with SWAP & CROSS CHAIN BRIDGE is LIVE now.

Devs cooking for 3 Month on this and a FULL TOKEN MANAGEMENET SOFTWARE ON SOLANA:

https://app.bemeow.club

We're just getting started ✨

There are not many times in life you get the chance to invest early in a unique Project with Utility & the Power of Meme. But this is THE ONE 🔥

#memecoins #catcoin #cats #meow #bullish #BullVerse #presale😻😻

At BEMEOW we do things different!! We bring intrinsic value to the Memecoin space and enable the Community to participate in launching Memecoins.

We launch TAX TOKENS!!! So we don't earn from dumping on the community. We earn from Volume & Volatility as it should be. And we reinvest 80% of these Taxes into Buybacks, Rewarding the Community and Growing the Ecosystem. 😺

Let's rebuild this screwed Memecoin Space from the Scratch TOGETHER and mark a new Standard of what a good Memecoin is 💖💖💖

Our Presale App with SWAP & CROSS CHAIN BRIDGE is LIVE now.

Devs cooking for 3 Month on this and a FULL TOKEN MANAGEMENET SOFTWARE ON SOLANA:

https://app.bemeow.club

We're just getting started ✨

There are not many times in life you get the chance to invest early in a unique Project with Utility & the Power of Meme. But this is THE ONE 🔥

#memecoins #catcoin #cats #meow #bullish #BullVerse #presale😻😻

1 yr. ago

Bittensor's cryptocurrency $TAO has climbed 100% in 2 weeks, how to explain it? 📈

This increase is driven by the rise of AI-related tokens 🤖 , boosted by announcements such as the results of nvidia and the new model of OpenAI .

Bittensor stands out with the upcoming launch of smart contracts, strengthening its interoperability and its advances in #IA decentralized 🌐

This increase is driven by the rise of AI-related tokens 🤖 , boosted by announcements such as the results of nvidia and the new model of OpenAI .

Bittensor stands out with the upcoming launch of smart contracts, strengthening its interoperability and its advances in #IA decentralized 🌐